...She drives real fast, and she drives real hard,

She's the terror of Colorado Boulevard...

At least, that's the way the lyrics go in that old tune Jan and Dean first recorded in the 1960s. However, in this case, I'm not talking about any granny who drives a brand new shiny red super-stocked Dodge with a four-speed stick and a four-two-six.

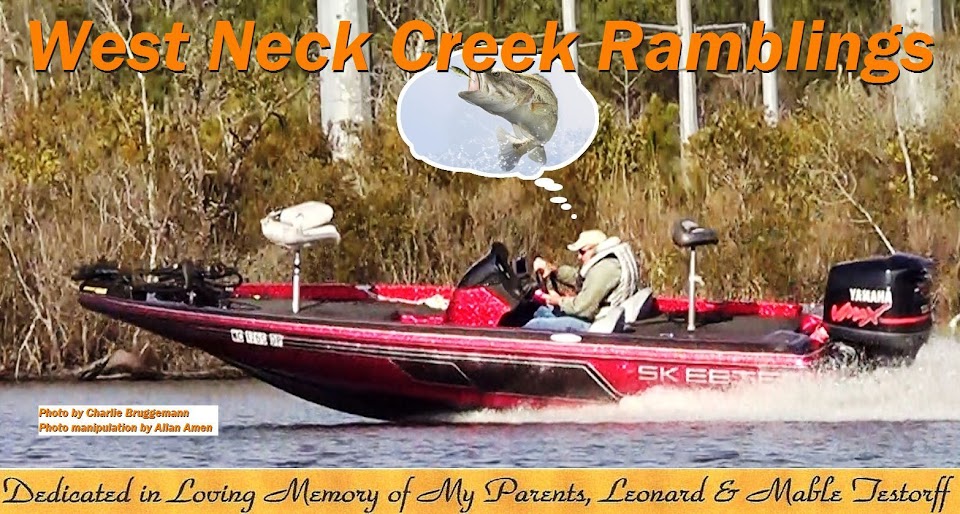

Instead, I'm talking about a fella who drives an immensely overpowered old red and white bass boat the length of West Neck Creek nearly every day. If you see or hear the boat coming (you really can't miss that sound because the decibels it puts out rival those of the Oceana jets), my advice to you is: Get out of the way!

I know wherefore I speak--I had my own recent close encounter. I don't remember another time when I've come any closer to needing a clean pair of skivvies than when I glanced over my shoulder and saw what was coming. Let's just say I knew in an instant it definitely wasn't Saint Nick flying in to drop off a late Christmas present.

But you know what? This guy really isn't breaking any laws that I can find. For openers, there are no posted speed limits for the waterways around here, other than for some "no wake" signs, and none of those signs were in sight the other day when I had my chance encounter. Furthermore, that "maximum horsepower" capacity plate you find on every boat is just a "recommendation"--one that's regularly gaffed off by a multitude of boaters, as I learned during my research. Some dudes even brag openly about how they remove those capacity plates and hang any motor they want on the back of their boats. According to the information I gleaned, neither the Department of Game and Inland Fisheries, nor the U.S. Coast Guard will routinely ticket an overpowered boat. And, of course, Virginia is among that vast majority of states (I think the total is 48) that don't have a law requiring any boat insurance.

One occasion when an overpowered boat operator and/or owner tends to find themselves in deep trouble is if/when they're found at fault in an accident in which someone is seriously injured or killed, or there is property damage. Then the walls of Jericho very well may come crashing down around them.

As I saw posted in an online forum, "You'll probably get sued for everything you own and end up with a cellmate named Bubba. Anytime you're in an accident that involves injury or loss of life, they throw the book at you. It's not the fine you have to worry about; it's that ambulance-chasing lawyer waiting for you. And if, perhaps by lying or using some other illegal means, you've managed to obtain boat insurance, you're kidding yourself if you think the company is going to come to your assistance when they learn you were running an overpowered boat. They're going to be the ones running then--in the opposite direction."

To the best of my knowledge, my boat is legal in every respect, and I do have full-coverage insurance, including, since the company first offered it, "uninsured boaters" coverage. Because Virginia doesn't require it is just that much more incentive for me to have it--that's my logic for protecting my ASSets. I'm guessing there are a lot of folks running around the local waterways all the time without a lick of coverage, so I feel highly motivated to keep my six covered.

One way I've learned to get a feel for those who do and don't have boat insurance, without asking the obvious question, is to mention the topic in a group setting--like a bunch of anglers standing around swapping fish tales. You'll nearly always see some immediately make their way to the nearest exits, while others suddenly will run out of things to say, and a few may even readily admit that they have no insurance. Regardless, you quickly get an idea of whose boats you want to steer clear of, especially on a morning when you're both trying to pick your way through the same dense fog.

No one plans on having accidents, but they do happen. And unless you have a boatload of extra cash laying around within easy reach, the only smart thing to do is to find a reputable insurer and pay those monthly premiums.

Oh, and if you plan to spend much time in West Neck Creek, you might want to consider either carrying a change of underwear...or maybe some Depends...whichever suits your personal taste.

No comments:

Post a Comment